Unless a financial institution has a permissible purpose as enumerated in the FCRA, a financial institution cannot obtain a consumer report nor can a consumer reporting agency provide one.

#PRESCREEN CREDIT OFFERS SERIES#

Please Note: This is the two hundred-fifty-second blog in a series of Back to Basics blogs, in which relevant and resourceful information can be easily accessed by clicking Dentons - Consumer Finance Report. To receive weekly insights to your email from the Consumer Finance Report blog, subscribe here.The federal Fair Credit Reporting Act (FCRA) strictly regulates the use of consumer reports, which contain highly sensitive information bearing on a consumer's credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. Make sure that the Truth-in-Lending Act and state law disclosures are all made, and that both of the FCRA notices appear as well. Practice Pointer: Take another look at your firm offer of credit. It may seem silly to require both notices-which provide the same basic information-to appear in the firm offer of credit. However, the law permits the notice to appear on either side of a two-page solicitation and contract-on front or back. The long form notice may often appear within the body of the contract and disclosures-that is, within the loan agreement itself. And, this short form notice must steer consumers to the long form notice. It must be conspicuously given and inform the consumer that he or she has the right to opt-out of prescreened offers and provides a toll-free telephone number to opt-out. These are known as the “short notice” and the “long notice.” Traditionally the short notice is given on the “marketing page” that accompanies most firm offers of credit. One of the interesting features of the FCRA is that it requires not just one, but two, notices to accompany the firm offer of credit.

This instrument literally allows the consumer recipient to cash a check, thereby initiating a loan. This is often done in the form of a “live check” or “check in the mail” with all of the disclosure bells and whistles included in the instrument. Well, based on the CRA results, the creditor must extend or make the firm offers of credit.

As long as the consumer has not elected to opt-out of prescreen offers, the CRA must include all consumers in its data base fitting the chosen criteria.

#PRESCREEN CREDIT OFFERS ZIP#

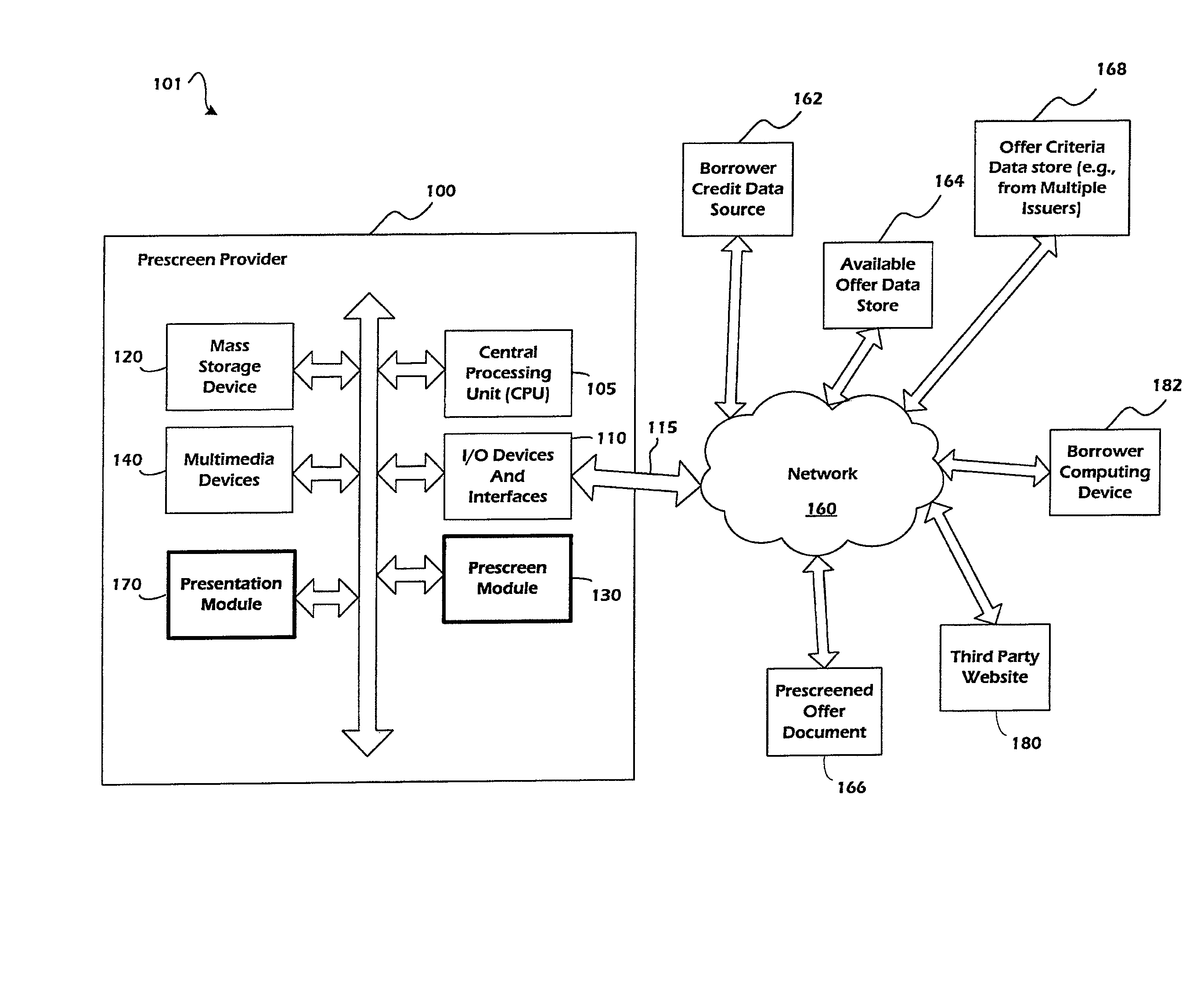

The criteria often includes characteristics such as ZIP code, credit standing or credit score, number of active accounts, high credit and consistency in making payments. See Back to Basics Continued-The Guaranteed Offer of Credit! The basic principle is that a creditor is permitted to seek a prescreened list of consumers from a CRA, if the creditor is, in fact, going to make a firm offer of credit to all consumers meeting the criteria of the request. I have written previously about “firm offers of credit” and the requirements that are placed on the creditors and on the CRAs. That exception involves the creditor seeking a prescreened list of consumers for the purpose of making a “firm offer of credit” to the chosen few-or many-who meet the criteria outlined by the creditor in its request to the credit reporting agency (CRA).

The FCRA does permit obtaining a consumer report in several circumstances-but there is a rare exception allowed for obtaining a report in connection with the initial extension of credit to a consumer who has not yet applied for credit. The Fair Credit Reporting Act (FCRA) governs offering credit to consumers who have not applied for credit.

0 kommentar(er)

0 kommentar(er)